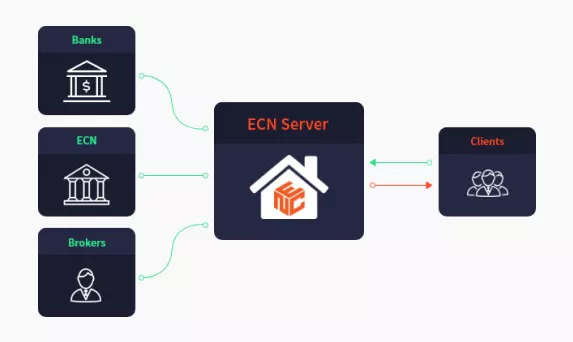

ECN stands for ‘electronic communication network’ and refers to an automated component of trading that connects individual traders to liquidity providers including banks, brokerages and even other traders. This process provides access to the financial markets to individuals with any type of trading account and regardless of their balance size.

An ECN broker is usually a No Dealing Desk (NDD) broker, which means that the clients’ orders do not pass through a Dealing Desk, which enables execution in a direct connection between the parties.

Lets get down to the details

An ECN is an automated system that publishes orders entered by market participants directly to third parties and individual traders. Those orders are then automatically executed by matching buy and sell orders at the best price available.

ECN trading is an extremely efficient process using sophisticated technology. Linking all traders, large and small, directly with liquidity providers eliminates the need for a ‘middleman’ in your transactions.

ECN trading provides you with tighter spreads and greater depth in market pricing. This is because the ECN broker consolidates quotes from several participants in order to offer you the tightest bid/ask spreads available. This highly automated trading process results in real-time market quotes and speedy execution!

Envision it as a marketplace for broker’s clients to trade with each other, so traders like you can get the best possible offer at that moment in time.